A lot can happen in 12 months.A year ago New Zealand, and the rest of the world, was reeling not just from the impact of an international pandemic, but also from the absence of any precedent in terms of what that felt like and how to deal with it.

Now, we do know what the effects are.

The phrase the `new normal’ may have been coined back then, but it’s only now that it’s truly `normal’. Quarantine-free entry to New Zealand is only available to a tiny percentage of the world’s population, international supply chains are still frustrated, migrant seasonal labour remains in short supply and the tourism and hospitality industries continue to take a battering. As serious as these things are, they’re accepted and understood as being part of the world we now live in.

However, these COVID-19 indicators are not necessarily known to the majority of the Not for Profit Sector. The sector of course involves a labour force, but one that is largely domestic and usually focused around the delivery of services and intangible commodities. There are international Not for Profit organisations represented in New Zealand, but they don’t dominate the sector. What then, have been the influences on this sector’s remuneration landscape for the last year?

Completely separate to the Coronavirus, the final instalment of the Government’s programme to increase the minimum wage to $20 per hour by 2021 was completed, and again we saw upward pressure being felt at the lower end of the remuneration market. When we look at market movements where these roles sit (administrative, semi-skilled & working supervisors) we are seeing average increases in fixed remuneration of 4.0%.

When we look at the Not for Profit sector in a more holistic sense, overall increases are 2.4%. If the percentage increases for smaller sized jobs are 4.0%, then it comes as no surprise that for technical specialists, that team leaders and middle managers increases were 2.3%. Increases for Senior manager and some Chief Executive jobs were at an even lower 0.4%. As was the case last year and the year before it appears that organisations have again focused salary budgets on the lower paid part of the workforce.

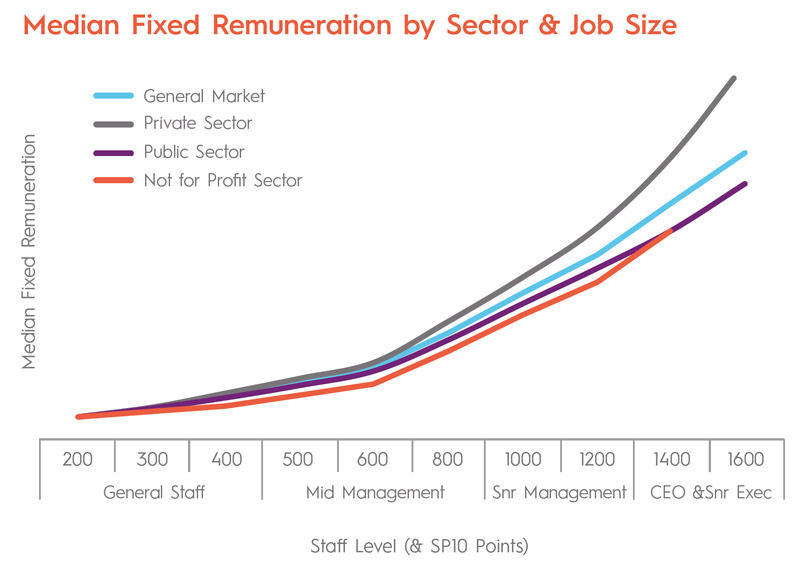

What does this mean for the broader Not for Profit Sector relative to other remuneration markets?

In recent years we have seen the Not for Profit market close the gap slightly against the broader General Market. It’s important though, to appreciate how slight this reduction in distance is. In 2020 the overall average gap in median fixed remuneration between the Not for Profit Sector and the General Market decreased from 16.0% to 15.7%.

That said, the practice has continued at a slightly increased rate. Overall General Market movements over the past year have generally been around 1.0%; possibly due to being more sensitive to the impact of COVID-19. With an overall movement of the Not for Profit Sector being 2.4%, there has been a minor `catch-up’ (albeit for mainly smaller-sized jobs). Specifically, the gap decreased from 15.7% to 15.1%.

When we look at projected increases over the next 12 months in the Not for Profit Sector overall, the median projections are 2%. This is unchanged from last year’s projections. The upper quartile projections are at 3.0%, up on last year’s 2.6%. However, median forecasts for the General Market are 1.5%. If these forecasts are accurate, some more modest closing of the gap could continue.

None of this is to imply that the Not for Profit Sector is having it easy. If COVID-19 affects government funding, sponsors, fundraising and the users of the sector’s services, then it affects the Not for Profit Sector. Affordability, too, has been stressed more highly this year than usual as an influence on pay increases. In 2020, 75% of organisations reported it as a consideration. This year, the figure is 85%. The percentage of organisations engaging volunteers for routine activities has jumped from 68% in 2020 to 80% in 2021. It is worth mentioning, too, that this year’s overall movement of 2.4% is down on last year’s 2.8%

While the comparative buoyancy in the sector’s remuneration movements cannot go unnoticed, the difference is essentially that; a comparative one. While the sector has seemingly not been impacted as much as others in terms of overall percentage movements, further analysis reveals a weighting towards only particular jobs. The sector’s challenges remain, and it still significantly lags the broader market.

By Craig Cameron, consultant at Strategic Pay

At Strategic Pay, we specialise in helping organisations retain and motivate key talent. Get in touch today to find out more. www.strategicpay.co.nz | [email protected]

Auckland | Hamilton | Tauranga | Wellington | Christchurch | Dunedin