Glance briefly south-westward from Auckland Harbour Bridge and the spiky forest of masts rocking gently at berth in one of the southern hemisphere’s biggest marinas is just one hint of how big the business of boating is in New Zealand.

Basecamp for upwards of 1800 boats – many millions of dollars worth of hulls and hardware – Westhaven and its surrounds also serve as the nerve centre for marine industry worth an annual $1.8 billion and, despite tough selling conditions offshore, still growing. Loss of the America’s Cup and high Kiwi dollar may have taken some wind out of export sales but, according to report released late last year by research company Market Economics, the industry as whole is still making way.

The independent report proved pleasant surprise for Peter Busfield, executive director of the Marine Industry Association (MIA), which represents 470 member companies.

“We thought if we were marking time we’d be happy because up to 2003 we’d had exponential growth domestically, and export-wise we had all this activity around the America’s Cup. New Zealand was really booming.”

From 1997 the marine export sector had been enjoying 23 percent compounding growth rate year on year, some of it fuelled by favourable exchange rates but much gained from leveraging New Zealand’s reputation for quality and innovation in offshore markets. Then the Cup went north, the dollar ditto and the world was rocked by terrorist attacks, war and the SARS outbreak.

“Trading conditions for our members have been pretty difficult over the past couple of years so it was encouraging for us to see this increase in turnover. I think we’ve done very well to grow exports in these circumstances,” says Busfield.

Although it is based on strong domestic market (over 100 new boats go into New Zealand each week), the industry has to look offshore for growth if it’s to meet its forecast turnover in 2020 of $3.16 billion – sum that involves quadrupling the income from its superyacht sales.

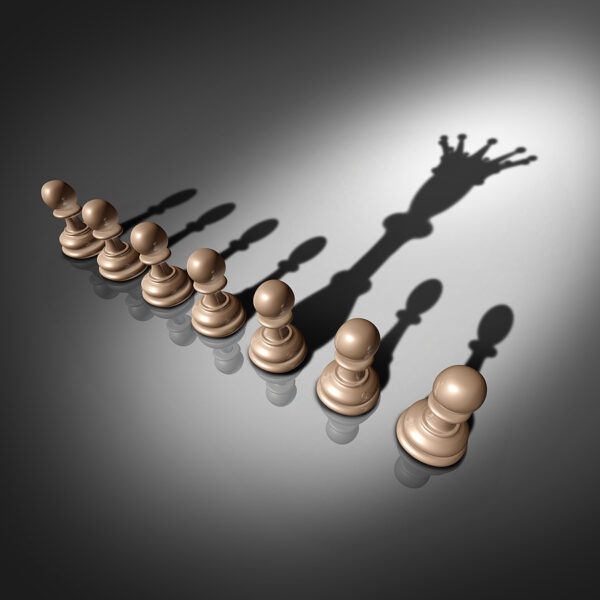

As New Zealand’s largest manufacturing sector, the marine industry faces many of the same challenges outlined in our cover story – high dollar, rising interest rates, competition from emerging countries, skills shortages, paucity of venture capital sources, plus rising fuel and raw material costs. On the plus side, it has built brand that has something of roaring 40s impact in northern hemisphere markets – we are known for punching above our weight in terms of design, innovation and quality of our marine products.

A summary of marine sector turnover for 2005 shows the largest and fastest growing sector in dollar terms is the supplies/services/components sector now worth $457 million and representing 29 percent of the total market share. Although the annual turnover for superyachts and race yachts has declined little over the past couple of years, trailer powerboats have bounced up, as have refits and maintenance.

“What these figures don’t show you is the volume of goods being exported,” says Busfield. “A number of our members report very good, strong growth in offshore sales but that’s not reflected in dollar values at this stage because of trading conditions. Anecdotally, the export side of superyacht sales and trailer powerboat sales overseas has been very good and orders are starting to roll in at the high exchange rate.”

He reckons dollar stability, even at higher rate, is an important factor because it gives quotes longer shelf life. Given that most top-end boat purchases tend to have one- to three-year timescale, buyers can be put off if the price keeps going up.

And at the top end of the market, you’re talking big bucks. Just the rigging for 100-foot superyacht can set you back $1.5-$2 million or up to $5 million for something bigger. But even in more dollar sensitive mass production areas such as equipment and accessories, Kiwi-made is holding its own, says Busfield.

“We’re getting orders at the higher exchange rate because people appreciate the quality of our design and manufacture and the profile of having New Zealand made look.”

Our international reputation is very high, agrees Kevin McPherson, general manager of the New Zealand Marine Export Group.

“People can identify with our sailors – there are lot of New Zealand skippers involved in the superyacht industry. There’s also the skill level of our workforce. We have very high respect from our international competitors in markets in terms of what we can achieve.”

Recent proof of this respect for Kiwi know-how came when Busfield grabbed the opportunity to look in on the construction of one of the largest ever composite race yachts being built in Italy and found the place awash with New Zealanders.

“When I walked into this top factory the first thing I noticed was everyone seemed to be speaking English – then I learned that out of the 20 specialist workers laying up this boat, 17 were Kiwis. So here I was looking forward to seeing the latest in international technology and what I saw was the sort of stuff being done on my own doorstep by people trained in Tauranga, Auckland, New Plymouth and Whangarei.”

Busfield gives the Government full marks for its apprenticeship scheme.

“It has been revolutionary in its approach to trade training and this will be one of the major factors that takes New Zealand forward. It gives the authority and responsibility to industries themselves to take ownership of their training so it’s relevant to employer requirements and ensures trainees are respected by the industries they’re going to work in.

“We have more boat building trainees in New Zealand than any other country in the world – and that’s not based on per capita ratio. We have over 400 trainees here compared to 300 in the United Kingdom. In the past four years more than 400 graduates have come through the system and next year there’ll be over 500.”

Sure, some will head offshore – it’s commercial reality that people trained here will often go overseas to advance their own development. At the same time, the country also attracts skilled folk from offshore largely because we’re known as boating nation.

“Our forefathers were pretty adventurous coming so far across the ocean to what is very coastal nation – we’ve got it in our blood,” says Busfield. “And there’s that No 8 wire mentality thing. Boats are very much the sort of product where you need to be flexible in your approach to design, build, engineering, maintenance – and New Zealand is blessed with climate and coast that allow us to go boating at any time. We have great testing ground in which to develop the innovations that have helped us win the America’s Cup and other races.”

For those commissioning big yachts, we also have the advantage of being “one-stop shop” – all the various specialists, whether riggers or refrigeration, electronics or exhausts are based in much the same area. One rep for an overseas superyacht owner recently told Busfield that what he’d achieved in Auckland over three days would have taken three months anywhere else.

“Coordinating everyone to come along and commission their products to make sure it’s all running properly is major exercise that can take months in any other city around the world whereas in Auckland, they’re mostly based around Westhaven. This is probably the world’s leading commissioning base,” says Busfield.

However he worries that this status is under threat from planned redevelopment of the Auckland waterfront that could see some marine industry services pushed out of the area.

“We’re strongly lobbying to retain our patch down here because if it’s taken away we’ll lose orders.”

Which highlights another aspect of the marine industry’s success – collectivism.

Pulling together

Taking leaf from New Zealand’s farming sector, marine industry participants are gaining market clout by working cooperatively. One reason why both Busfield and McPherson are little hard to pin down is that, apart from building contacts through offshore